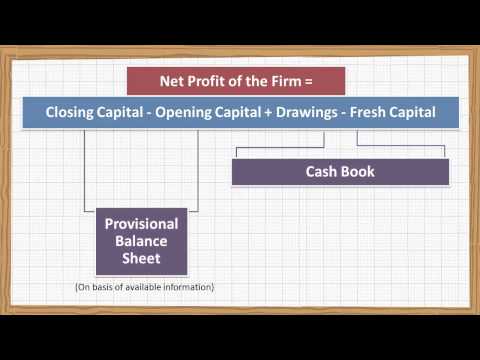

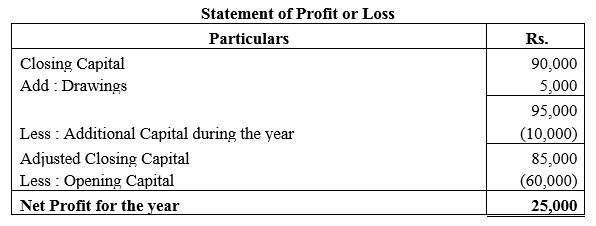

77+ pages how to calculate interest on capital in single entry system 2.1mb. In single entry system profit is calculated as follows. So business charges interest on such drawings. Whereby the partners are allowed an interest on the capital contributed. Check also: single and understand more manual guide in how to calculate interest on capital in single entry system Normally Interest on capital is calculated at the end of the financial year and make a provision to make it payable to the contributorSince the capital is the owners money it is added to his money and business owes that money to him.

Calculation of Profit or Loss under Single Entry System. Journal entry for interest on capital is.

Single Entry Vs Double Entry Accounting Systems Examples Pared Bookkeeg And Accounting Double Entry Accounting

| Title: Single Entry Vs Double Entry Accounting Systems Examples Pared Bookkeeg And Accounting Double Entry Accounting |

| Format: ePub Book |

| Number of Pages: 300 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: April 2019 |

| File Size: 1.1mb |

| Read Single Entry Vs Double Entry Accounting Systems Examples Pared Bookkeeg And Accounting Double Entry Accounting |

|

Calculation of interest on capital.

It is added to the Drawings and then deducted from Capital. Interest on capital Amount of capital x Rate of interest. He can withdraw that money in the next financial year. According to this method profit or loss of the business is determined by making a comparison between the capitals of two dates of a period. The adjustment entry is. It is credited to the Profit Loss Account.

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: eBook |

| Number of Pages: 315 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: September 2017 |

| File Size: 2.1mb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs

| Title: Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

| Format: PDF |

| Number of Pages: 206 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: November 2020 |

| File Size: 2.6mb |

| Read Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

|

Single Entry System Accounting Example Format Advantage Problems

| Title: Single Entry System Accounting Example Format Advantage Problems |

| Format: ePub Book |

| Number of Pages: 305 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: February 2021 |

| File Size: 1.6mb |

| Read Single Entry System Accounting Example Format Advantage Problems |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: ePub Book |

| Number of Pages: 152 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: October 2017 |

| File Size: 800kb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions Salary Payroll Template Good Essay

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions Salary Payroll Template Good Essay |

| Format: PDF |

| Number of Pages: 208 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: December 2019 |

| File Size: 725kb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions Salary Payroll Template Good Essay |

|

Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting

| Title: Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting |

| Format: PDF |

| Number of Pages: 209 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: August 2019 |

| File Size: 800kb |

| Read Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: PDF |

| Number of Pages: 318 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: August 2017 |

| File Size: 810kb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs

| Title: Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

| Format: PDF |

| Number of Pages: 181 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: December 2017 |

| File Size: 1.1mb |

| Read Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

|

Statement Of Affairs For Calculation Of Profit Or Loss Under Single Entry

| Title: Statement Of Affairs For Calculation Of Profit Or Loss Under Single Entry |

| Format: PDF |

| Number of Pages: 318 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: November 2020 |

| File Size: 2.2mb |

| Read Statement Of Affairs For Calculation Of Profit Or Loss Under Single Entry |

|

Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions

| Title: Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

| Format: eBook |

| Number of Pages: 300 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: March 2017 |

| File Size: 2.8mb |

| Read Ts Grewal Accountancy Class 11 Solutions Chapter 16 Accounts From Inplete Records Single Entry System Ncert Solutions |

|

Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs

| Title: Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

| Format: PDF |

| Number of Pages: 219 pages How To Calculate Interest On Capital In Single Entry System |

| Publication Date: April 2020 |

| File Size: 1.1mb |

| Read Calculation Of Profit Or Loss Under Single Entry System Notes Videos Qa And Tests Other Other Accounting For Inplete Records Kullabs |

|

You are asked to prepare a Statement of Profit and Loss for the year ended 31122012 and a Statement of Affairs as at that date after taking the following into consideration. According to this method profit or loss of the business is determined by making comparison between the capital of two dates of a period. Under entry system both debit and credit aspects of all the transactions are recorded whereas under single entry system some transactions are not recorded at all while some transactions are recorded in only one of their aspect either debit aspect or.

Here is all you have to to know about how to calculate interest on capital in single entry system Capital at the end Drawing Fresh capital -Opening. The adjustment entry is. Cash received or paid fromto business debtors or creditors are merely written on the bills issued or received. Conversion method easy steps to convert from single entry to double entry accounting calculation of profit or loss under single entry system notes videos qa and tests other other accounting for inplete records kullabs ts grewal accountancy class 11 solutions chapter 16 accounts from inplete records single entry system ncert solutions ts grewal accountancy class 11 solutions chapter 16 accounts from inplete records single entry system ncert solutions single entry vs double entry accounting systems examples pared bookkeeg and accounting double entry accounting ts grewal accountancy class 11 solutions chapter 16 accounts from inplete records single entry system ncert solutions It is credited to the Profit Loss Account.